Kembali | Vol 6, No 3 (2017)

Article

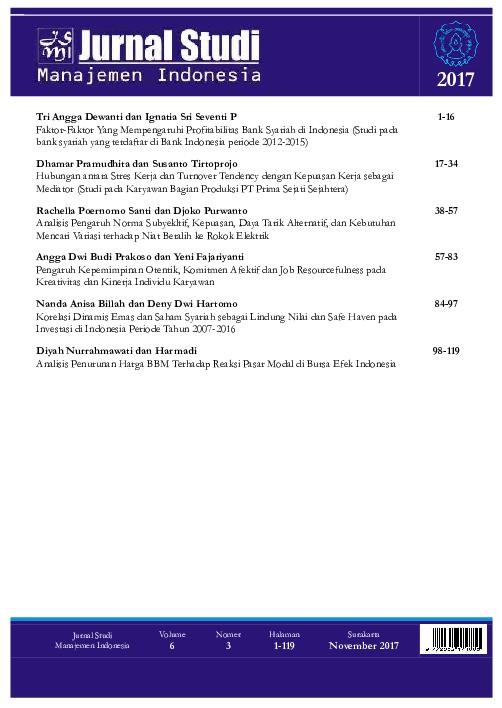

Diyah Nurrahmawati dan Harmadi

Abstract

This research is included in hypothesis testing research to: 1) market reaction to the announcement of BBM price reduction with abnormal return and trading volume activity, 2) difference of average abnormal return and trading volume activity before and after announcement of fuel price reduction. This research is conducted on stocks belonging to the mining sector and infrastructure, utilities, and transportation sectors in Indonesia Stock Exchange, taken by purposive sampling technique. The criterion of sample in this research is stock of company which in event period of active and not do stock split, dividend division, merger, or right issue. This study took a sample of 17 samples from the mining sector and 24 samples from infrastructure, utilities, and transportation sectors. The return of the samples is then re-directed to market returns using the market model. This study uses the approach of event study. The result of the research can be concluded that: 1) there is no significant difference in the abnormal return in both sectors, 2) there is no significant difference in the average abnormal return (AAR), but there is significant difference in the cummulative average abnormal return (CAAR) before and after the reduction in fuel price. In the mining sector, there is significant difference in the trading volume activity, but there is no significant difference in the trading volume activity for infrastructure, utilities, and transportation sectors before and after the reduction of fuel prices.

Keywords

oil price, government policy, market efficiency hypothesis, abnormal return, trading volume activity