Kembali | Vol 7, No 3 (2018)

Article

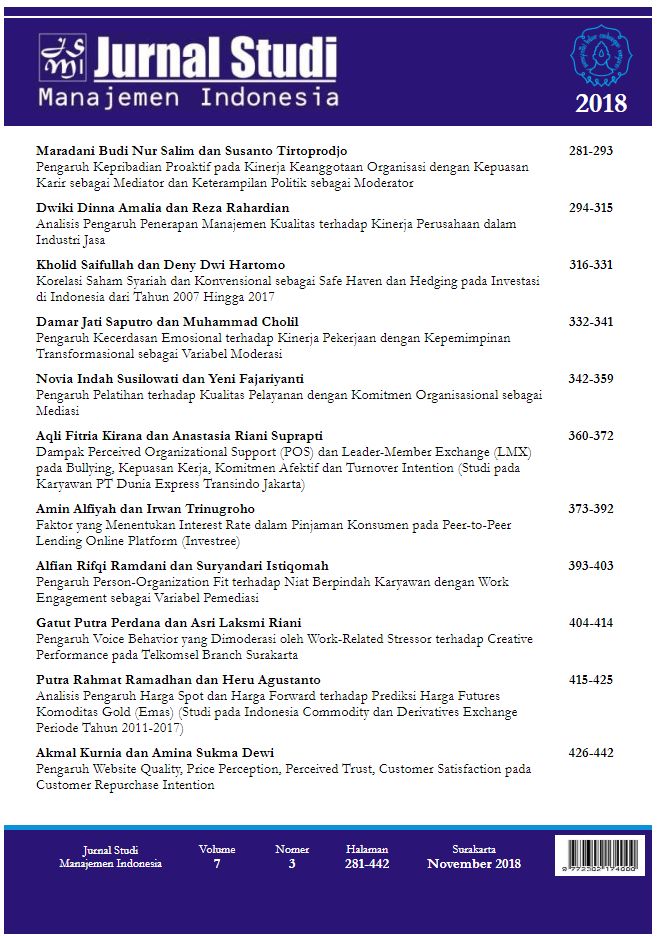

Kholid Saifullah dan Deny Dwi Hartomo

Abstract

This study examines the dynamic correlation between conventional stocks and Islamic stocks as hedging and safe-haven for investment in Indonesia. The author uses the A-DCC GARCH Model from the daily closing price from the price history of the Jakarta Islamic Index (JII) and Composite Stock Price Index (CSPI) for the period 2007 until 2017. The purpose of this research is to analyzing an investment choices that should be made by investors between conventional stocks, Islamic stocks or a combination of conventional stocks and Islamic stocks to protect financial assets, especially in the Indonesian financial market. In A-DCC model, conventional shares can be relied on as assets that result in an increase in Indonesia's investment returns in the coming period. Furthermore, Islamic stocks have not been able to be relied upon as assets that result in an increase in Indonesia's investment returns in the following period shortly. Therefore, knowing the correlation between the two assets shows that conventional stocks positively and significantly affect Islamic stocks. Thus, a combination of conventional shares and Islamic stocks can be a strong hedge for investment in Indonesia.

Keywords

hedging, safe haven, conventional stock, joint stock price index, Jakarta Islamic index, Islamic stock